REPUBLIC OF SOUTH AFRICA

IN THE HIGH COURT OF SOUTH AFRICA,

GAUTENG LOCAL DIVISION, JOHANNESBURG

REPORTABLE: NO OF INTEREST TO OTHER JUDGES: NO 20 February 2023 ………………………... DATE SIGNATURE

In the matter between:

43 AIR SCHOOL HOLDINGS (PTY) LTD 1st Applicant

43 AIR SCHOOL (PTY) LTD 2nd Applicant

PTC AVIATION (PTY) LTD 3rd Applicant

JET ORIENTATION CENTRE (PTY) LTD 4th Applicant

And

AIG SOUTH AFRICA LTD Respondent

(This judgment is handed down electronically by circulation to the parties’ legal representatives by email and by uploading it to the electronic file of this matter on CaseLines. The date for hand-down is deemed to be 20 February 2023.)

JUDGMENT

MIA, J

[1] The applicants sought the following relief.

“1. Declaring that the respondent is liable to compensate the second, third and fourth applicants in respect of business interruption insurance cover, from the period from 27 March 2020 to 31 May 2020.

2. Directing the respondent to engage the second, third and fourth applicants meaningfully for the purposes of quantifying the monetary value of the claims of each of the second, third and fourth applicants for compensation in respect of business interruption insurance for the period from 27 March 2020 to 31 May 2020.

3.Directing the respondent to pay the applicants costs.”

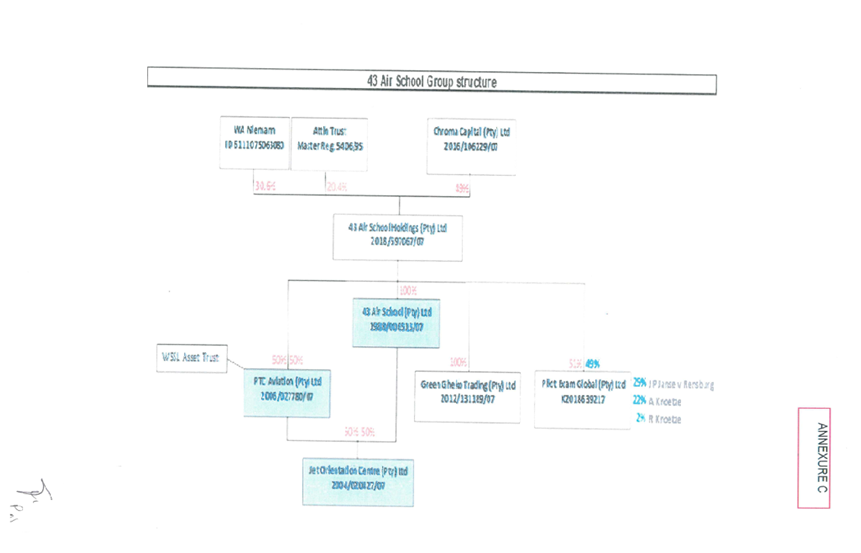

[2] The first applicant is 43 Air School Holdings (Pty) Ltd (Holdings), it has 100 percent shares in the second applicant, 43 Air School (Pty) Ltd (43 Air School). 43 Air School is the main operating entity which consists of all four applicants.

[3] The third applicant is PTC Aviation (Pty) Ltd (PTC). Holdings holds 50 percent shares in PTC and the balance is held by a Trust. The fourth applicant is Jet Orientation Centre, (Pty) Ltd (JOC). PTC and 43 Air School hold shares equally in JOC, making 43 Air School an effective holder of 75% of shares in JOC.

[4] The respondent in the matter is AIG, South Africa Limited (AIG), an insurance company.

[5] 43 Air School was the main operating management entity within the 43 Air School group. It held short term insurance which included business interruption insurance cover with the respondent for the period 1 July 2019 to 30 June 2020, arranged by Marsh (Pty) Ltd (Marsh) who was the insurance broker and the underwriter in respect of the policy with AIG. The policy ran from 1 July to 30 June every year and had been in place for a number of years. The applicants were required to complete an insurance renewal questionnaire transcribing the insurance values for each year. The second applicant did so for 2019 to 2020 on behalf of the group. The updated questionnaire was submitted on 7 June 2019 to Marsh to forward it to AIG.

[6] The policy covered business interruption and the applicants referred to the specific definitions in the policy which included definitions of the “business” and the “premises” and a “defined event” for the purpose of business interruption:

“SPECIFIC DEFINITIONS

Business shall mean any activity of the insured

Premises shall mean any premises used for the purpose of the insured.

And

EXTENDED DAMAGE

The Defined event extends to include:

a)

b)

c)

d)

e)

f) outbreak of infectious or Contagious disease within a radius of 25 kilometres of the premises. Infectious or Contagious Disease shall mean any human infectious or contagious illness or disease which a competent authority has stipulated shall be notified to them or has caused a competent authority to declare a notifiable medical condition to exist or impose or impose quarantine regulations or restrict access to any place. “

[7] The policy also required claims to be submitted within a particular period

under its reporting of claims clause as follows:

“SPECIFIC CONDITIONS

2 CLAIMS

On the happening of any defined event in consequence of which a claim may be made under this section the insured shall in addition to complying with General condition 1- Reporting of claims and General Condition 2 – Insurers rights with due diligence do and concur in doing and permit to be done all things that may be reasonably practicable to minimise or check any interruption of or interference with the Business or to avoid or diminish the loss and in the event of a claim being made under this section, shall at their own expense (subject to the provisions of General Extension 1-Claims Preparation Costs) deliver to the insurer in writing a statement setting forth particulars of their claim together with details of all other insurance covering the loss or any part of it or consequential loss of any kind resulting therefrom. No claim under this section shall be payable unless the terms of this Specific condition have been complied with and in the event of non-compliance therewith in any respect, any payment on account of the claim already made shall be repaid to the insurer forthwith”

[8] 43 Air School, PTC and JOC allege that in 2020, they suffered losses as a result of the national lockdown declared in terms of Disaster Management Act 57 of 2002 that came into effect on 26 March 2020. 43 Air School prepared and submitted a claim to the respondent under the policy in March 2020. This claim was rejected by the respondent.

[9] The applicant’s claims submitted to the respondent over the period amounts to the sum of R4,130,926. According to the applicants, the scope and quantum of their claim stands to be revised to include business interruption losses that relate to PTC and JOC. They seek a declaratory order to the effect that the respondent is liable to the applicants under the policy for the extent of their losses and to direct and that the respondent engages meaningfully with the applicants.

[10] The applicants conduct their business in the field of aviation. 43 Air School is based at Port Alfred and provides pilot training and air traffic control training from Port Alfred Aerodrome which is a dedicated flight training company. It caters for commercial, private and general airline and military sectors. 43 Air School with a purported extensive background in training, offers training to individuals, and corporate sponsored pilots from different backgrounds. It also trains pilots from various countries around the world. PTC operates an airline pilot preparation service exclusively for 43 Air School students and provides Boeing 737 and Airbus 320 flight training for newly qualified commercial pilots from their Gqeberha premises which are owned by Green Gecko Trading (Pty) Ltd (Green Gecko). The shares in Green Gecko are owned by Holdings.

[11] JOC owns and provides flight simulators for lease at the Gqeberha premises which are owned by Green Gecko and utilised by 43 Air School for PTC training purposes. 43 Advanced, was a division operated by 43 Air School. It provided re-currency and post-qualification training for pilots at Lanseria until the end of June 2020 when it closed due to the negative effects of the Covid 19 pandemic. The applicant indicated that 43 Air School provides the main administrative management function for each of the applicants. The pilot training courses offered are extensive and include private and commercial pilot license training. The training also includes airline pilot training that would lead to the integrated airline transport and instructor rating training, technical training, aircraft maintenance and mechanic training. The training is either offered at Port Alfred by 43 Air School or by PTC using aircraft simulators owned by JOC. The training is offered to the local as well as international market. They also conduct the training for the Vietnam Airline cadet program. The organogram relied on by the applicant is marked “Annexure” C below.

[12] The respondent was the insurer of the applicant for several years, up to June 2020. The premium including VAT was R 467 342,98 per annum. The policy covered business interruption for the amount of R 66 443 230.00 per annum. The applicant was required to complete a questionnaire at the beginning of each year relating to the insurance required. The questionnaire was completed as requested by the insurer and updated and submitted for the period 2019 to 2020. The insurance policy covered the business and premises in Lanseria, Port Alfred, and Gqeberha for assets to the value of R258,000,296.00 and in respect of cover for business interruption in the amount of R 66 443, 230.00. The meaning of business interruption as described in the policy is relied upon by 43 Air School who was compelled to changed its business location as it was fundamentally impacted by the national lockdown and Covid 19 disease was diagnosed within the 25 km radius when the Lanseria business closed. The 43 Air School premises based at the Port Alfred premises was also affected due to a defined incident, namely the diagnosis of Covid 19 within the 25 km radius impacting PTC as well, it was submitted. The rejection of PTC’s claim is not justified as a claim by PTC was accepted in the past in respect of a computer. JOC’s claim, the applicant submits, is correctly submitted along with the other claims. The applicants as the insured submitted claims to the respondent’s claims department in litigation.

[13] The respondent rejected 43 Air school’s first claim for the period 26 April to 9 June 2020 as it contends the national lockdown was not in response to an incident of Covid 19 within the 25 km radius of Port Alfred and the policy is not a joint policy. Thus the case in Gqeberha is not a trigger event for the second applicant to claim on the policy. Its second claim was not submitted prior to the launch of this application and again the respondent indicates it is not a joint policy. PTC’s claim for the period 27 March 2020 to 1 June 2020 was rejected because the respondent asserted that it was not submitted prior to the launch of this application and PTC is not insured under the policy. JOC’s claim was rejected because it was not submitted prior to the launch of this application. There is no major opposition to JOC’s claim.

[14] The issues for determination were agreed to be:

Whether PTC is an insured under the policy?

Whether the second third and fourth applicant are entitled to seek declaratory relief by way of litigation where only the second applicant submitted a claim for business interruption to the respondent from 27 April 2020 -31 May 2020 which was rejected by the respondent.

Whether the second applicant is entitled to indemnity under the insurance policy for the period during which its business was interrupted as a result of the lockdown but where the outbreak of Covid 19 occurred within the radial limit on a date after and could not have been the cause of the Government’s imposition of the lockdown imposed.

[15] In Guard Risk Insurance Company v Café Chameleon1 the Court states the approach to interpreting insurance contracts:

“This Court recently restated the approach to interpreting insurance contracts in Centriq v Oosthuizen:

“[I]nsurance contracts are contracts like any other and must be construed by having regard to their language context, and purpose in what is a unitary exercise. A commercially sensible meaning is to be adopted instead of one that is insensible or that is at odds with the purpose of the contract. The analysis is objective and is aimed at establishing what the parties must be taken to have intended, having regard to the words they used in the light of the document as a whole and of the factual matrix within which they concluded the contract”

[13] In this analysis it must be borne in mind that insurance contracts are “contracts of indemnity”. They should therefore be interpreted "reasonably and fairly to this end". In this

regard it is instructive to recall Schreiner JA's adoption of the following statement from the English authorities on insurance law:2 "No rule, in the interpretation of a policy, is more firmly established,

or more imperative and controlling, than that, in all cases, it must be liberally construed in favour of the insured, so as not to defeat without plain necessity his claim to indemnity, which in making the insurance, it was his object to secure. When the words are without violence, susceptible of two interpretations, that which will sustain the claim and cover the loss, must in preference be adopted.”3

whether the third applicant is covered under the insurance policy?

[16] Counsel for the applicants submitted that PTC was covered under the policy in view of 43 Air School managing the insurance for the group. The respondent disputed this on the basis that there was no connection between 43 Air School and PTC and the policy made no reference to PTC. Furthermore, PTC did not prove that it was covered under the policy. He argued that the wording of the policy is clear that insurance is afforded to NAC, 43 Air School and subsidiary companies “managed” and “controlled” by NAC and 43 Air School and for which they have authority to obtain insurance.

[17] Having regard to the guidance in para[12] of Guardrisk and its reference to Centriq v Oosthuisen to have regard to the language, context and purpose of insurance contracts in a unitary manner, I have considered the respondent’s admission in paragraph 80 of the answering affidavit where it states as follows:

“ I admit that AIG was the insurer of NAC and 43 Air School (Pty) Ltd and their respective subsidiary companies, managed, controlled, member companies,….and any other persons or entities for which they have authority to insure, jointly or severally each for their respective right or interests) for many years.”

[18] Counsel for the respondents argued that this was a factual consideration and not a legal one. The court had to consider whether the applicants had a joint interest. Counsel for the respondent submitted further, that it was incorrect to say that the businesses were inter –related. Having regard to the organogram he pointed out that Holdings was the overarching company. 43 Air School had no shareholder relationship with PTC. This relationship was only between 43 Air School and JOC when regard was had to the applicants’ organogram4. The NAC replaced by Holdings in the organogram. Counsel pointed out further that PTC was a subsidiary of Holdings and not of 43 Air School and 43 Air School could not have arranged insurance for PTC as a subsidiary.

[19] To the contrary, counsel for the applicants referred to the annexures, indicating it is evident that the insurance for the period from July 2019 was renewed as a composite insurance policy including NAC and 43 Air School (Pty) Ltd. The annexures completed by the deponent and submitted to Marsh reflect property belonging to PTC and JOC. It followed that they were included in the policy.

[20] Having regard to the facts and considering the documents which are attached as annexures which include the questionnaire concluded by Shaun Musson, the director of the applicants, as well as the email correspondence concluded prior to the renewal of the 2019 policy, reference is made to NAC and 43 Air School (Pty) Ltd and the admission is made that there was a history of covering both NAC and 43 Air School, including subsidiary companies which are managed and controlled. This would include Holdings and its subsidiaries and 43 Air School and its subsidiaries. This includes both PTC and JOC. My view is reinforced by the reference to specific items listed for cover belonging to PTC and JOC and the undisputed evidence that the respondent paid out a claim submitted by PTC previously. This in the light of their admission in paragraph [80] leads me to the conclusion that PTC was covered under the policy.

whether the second third and fourth respondents are entitled to interdictory relief where only second respondent submitted a claim

[21] The second applicant submitted its first claim for the period 27 April -31 May 2020. This claim was rejected for the reasons indicated above and based on the principle that 43 Air School’s claim for the period 26 -30 April 2020 was due to the lockdown and was not in response to a Covid 19 occurrence within a 25 km radius of the business premises in Port Alfred. The second reason the claim was rejected was because the policy is not a joint policy and an occurrence of an incidence of Covid 19 in Gqeberha was not within 25 km of Port Alfred. The third and fourth applicants’ claims were rejected because they failed to comply with the submission of claim as per a condition of the policy5 prior to approaching the court for relief, thereby depriving the respondents of their contractual rights to investigate the claims. There was an indication that the fourth applicant has a claim. There was a possibility that the third applicant’s claim would be considered provided the third applicant could prove it was insured. This court’s finding above indicates the third applicant was insured.

Joint and composite policy

[22] The question whether the applicants are entitled to declaratory relief is best answered by considering whether the policy was composite or considering whether the business was impacted by a defined event at Gqeberha.

[23] Counsel for the respondent pointed out that claims were subject to a time clause for example General Condition 1(b) provided time limitations which stated that “no claim is payable after the expiry of twenty four months or such further time as the insurer may in writing allow unless the claim is the subject of litigation still to be assessed or is a claim under the business interruption section of the policy”. The respondent rejected the claim of the second applicant on the strength of this clause. This necessitated the present application to enable the applicants to submit and negotiate claims in terms of the policy.

[24] Counsel for the respondent argued that the applicants are separate juristic companies and carry on business at different places. Thus it was argued they cannot rely on the policy to claim for the same incident.

[25] He argued that the question of the policy covering all the companies required the court to determine whether the policy was a composite one. In considering this reference he referred to the description of “the business” of the insured as well as the terms “business interruption”, “defined event”, “premises”. The respondents admitted in paragraph 80 they have covered the applicants for a number of years. The insured admitted covering the applicants as follows: ” National Airways Corporation (Pty) Limited and 43 Air School (Pty) Ltd and subsidiary companies managed, controlled member companies, joint venture sports, social and recreational clubs, and societies and any other persons or entities for which they have they have authority to insure, jointly or severally each for their respective right or interests) for many years.”

Thus, to make a determination whether the policy was a composite one, counsel submitted, was a factual determination. Having regard to the insurance policy, it is evident that it refers to companies which are managed and controlled as well as subsidiaries which are clearly under the control of Holdings which replaced NAC and 43 Air School which manages some subsidiaries and arranges insurance.

[26] A further consideration is the factual consideration whether the parties are impacted by the loss where there is a defined event. There was an incident of Covid 19 within the 25 km radius of JOC and PTC’s premises in Gqeberha. It was argued this did not qualify 43 Air School’s claims. The respondent based its decision on an understanding of a joint and composite policy and description of the insured’s business. Counsel referred to MacGillavray6

“There can be no joint insurance policy unless the interests of the several persons who are interested in the subject matter are joint interests so that they are exposed to the same risk and will suffer a joint loss by the occurrence of an insured peril…. The interests of such co-insureds are so inseparably connected that a loss or benefit must necessarily affect them both ”

…..

“It is usual to describe the co-insured in a composite policy as being insure for “their respective rights and interests” but a policy lacking that wording may nonetheless be construed as composite”7

[27] In the above paragraph it is evident that the wording used to identify a composite policy is found in the description of the definition of the insured namely “they have authority to insure, jointly or severally each for their respective right or interests.”(my emphasis). In addition to the description which define the elements, the event which impacted the one facility has an impact on the other facilities as well. The respondent did not dispute the applicants’ version regarding the losses suffered or that the business interruption of one facility did not impact the other. Having regard to the description of training services offered it is apparent that the facilities are inter related and supportive.

[28] Aviation is a specialised training area. The applicants describe in their founding affidavit how they offer training programmes at Port Alfred and Gqeberha. Some of the training such as the cadet training is conducted partly at Port Alfred and partly as Gqeberha. It is evident that an interruption at one site will impact the other site. On reading the policy “the business” is all of the places where business is conducted and is a factual determination. There is nothing to gainsay the version put forward by the applicants in the founding affidavit regarding the conduct of training. In Guard Risk8 , the Court referred to the flexible common sense approach to be adopted over strict logic in insurance contracts to give effect to the intention of parties in a contract:

“The commonlaw test is thus applied flexibly, recognising that “common sense may have to prevail over strict logic” in the contractual context it has long been accepted that causation rules should be applied “with good sense to give effect to, and not to defeat the intention of the contracting parties”.19 For insurance contracts the question always is:”[H] as the event, on which I put my premium, actually occurred?”

[40] Of relevance in the instant case is that they may be more than one cause or multiple causes giving rise to a claim. In that case “the approximate for actual or effective cause (it matters not what term is used) must be ascertained…”21 even if a loss is “not felt as the immediate result of the peril insured against, but occurs after a succession of other causes, the peril remains the proximate cause of the loss, as long as there is no break in the chain of causation.” 22 A proximate cause should be identified as a matter of reality, predominance [and] efficiency”. Put differently the real or dominant cause is ascertained by applying good business sense.

I am thus persuaded that the third and fourth applicants should, in line with the common sense approach that the Supreme Court of Appeal in Guardian Risk provides, be afforded relief. Especially as where they shared the same facilities to conduct training and for support and ongoing or secondary training. Not to do so would lead to an absurdity which the insurer (reasonably) and so too insured in this case the applicants, did not contemplate.

order

[29] For the reasons above, I make the following order:

The respondent is liable to compensate the second, third and fourth applicants in respect of business interruption insurance cover, for the period 27 March 2020 to 31 May 2020.

The respondent is directed to engage the second, third and fourth applicants meaningfully for the purposes of quantifying the monetary value of the claims of each of the second, third and fourth applicants for compensation in respect of business interruption insurance for the period from 27 March 2020 to 31 May 2020.

3.The respondent to pay the applicants’ costs.

_________________________________________________

S C MIA

JUDGE OF THE HIGH COURT OF SOUTH AFRICA

GAUTENG LOCAL DIVISION, JOHANNESBURG

Appearances:

On behalf of the applicant : Adv KJ Van Huyssteen

Instructed by : Fluxmans Inc

On behalf of the respondents : Adv I Green SC

R Ismail

Instructed by : Webber Wentzel

Date of hearing : 23 February 2022

Date of judgment : 20 February 2023

1 Guard Risk Insurance Company v Café Chameleon [2021] 1 All SA 707 (SCA)

2May on Insurance (4ed) at 174- 5 cited with approval in Kliptown Clothing Industries (Pty) Ltd v Marine and Trade Insurance Co of SA Ltd 1961 (1) SA 103 (A) at 107A-B

[also reported at [1961] 1 All SA 385 (A) Ed]. However, the recent statement in Ma- Afrika Hotels and Another v Santam Limited [2020] ZAWCHC 160 [reported] at [2020] JOL 48995 (WCC) Ed] at para does not accord with our law. It reads “Insurance is intended to serve as a social safety net to cover financially devastating losses and compensate injured parties. This is precisely the safety net required as a result of the unprecedented Covid 19 pandemic.”

3 At para [12]

4 See Annexure C above

5Caselines 001-122, General Condition 1(a) (iii) and 001-152 Specific Condition 2

6 Birds J, Lynch B, Paul S MacGillavray On Insurance Law – Relating to All Risks Other than Marine 1-202 Sweet and Maxwell 4th Ed. at para1-202

7 As above, para 1-204

8 Above para [39] –[40]